The W-9 form is a crucial document for many individuals and businesses in the United States. Whether you’re a freelancer, contractor, or business owner, understanding the ins and outs of this form can save you time and potential headaches during tax season. This article will provide a comprehensive overview of the W-9 form, its purpose, how to fill it out correctly, and why it’s important for both payers and payees.

Key Takeaways

- The W-9 form is used to collect taxpayer information for reporting purposes.

- It is primarily utilized by freelancers, independent contractors, and businesses.

- Providing accurate information on the W-9 is essential to avoid IRS penalties.

- Understanding the form’s purpose and requirements can streamline tax reporting.

What is a W-9 Form?

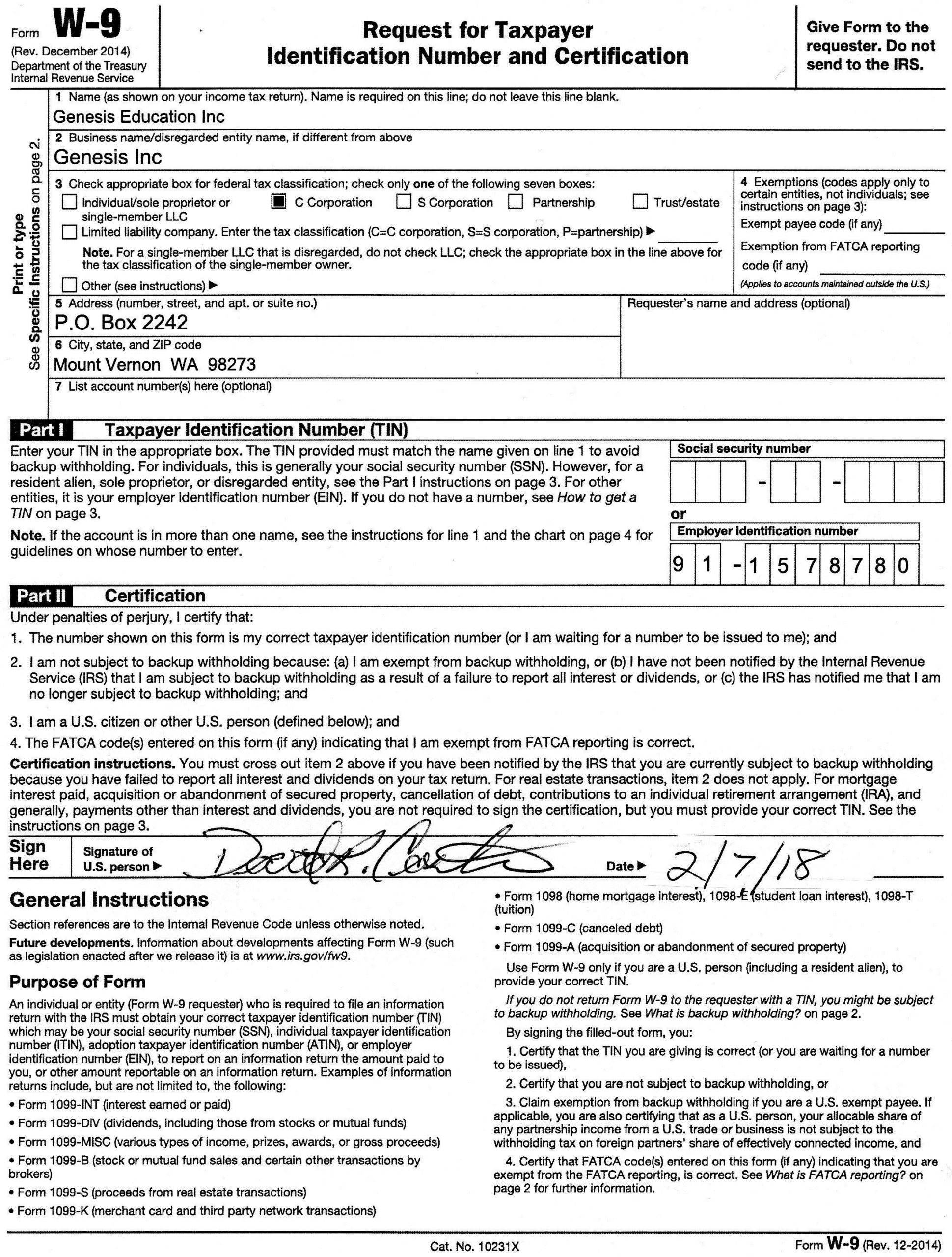

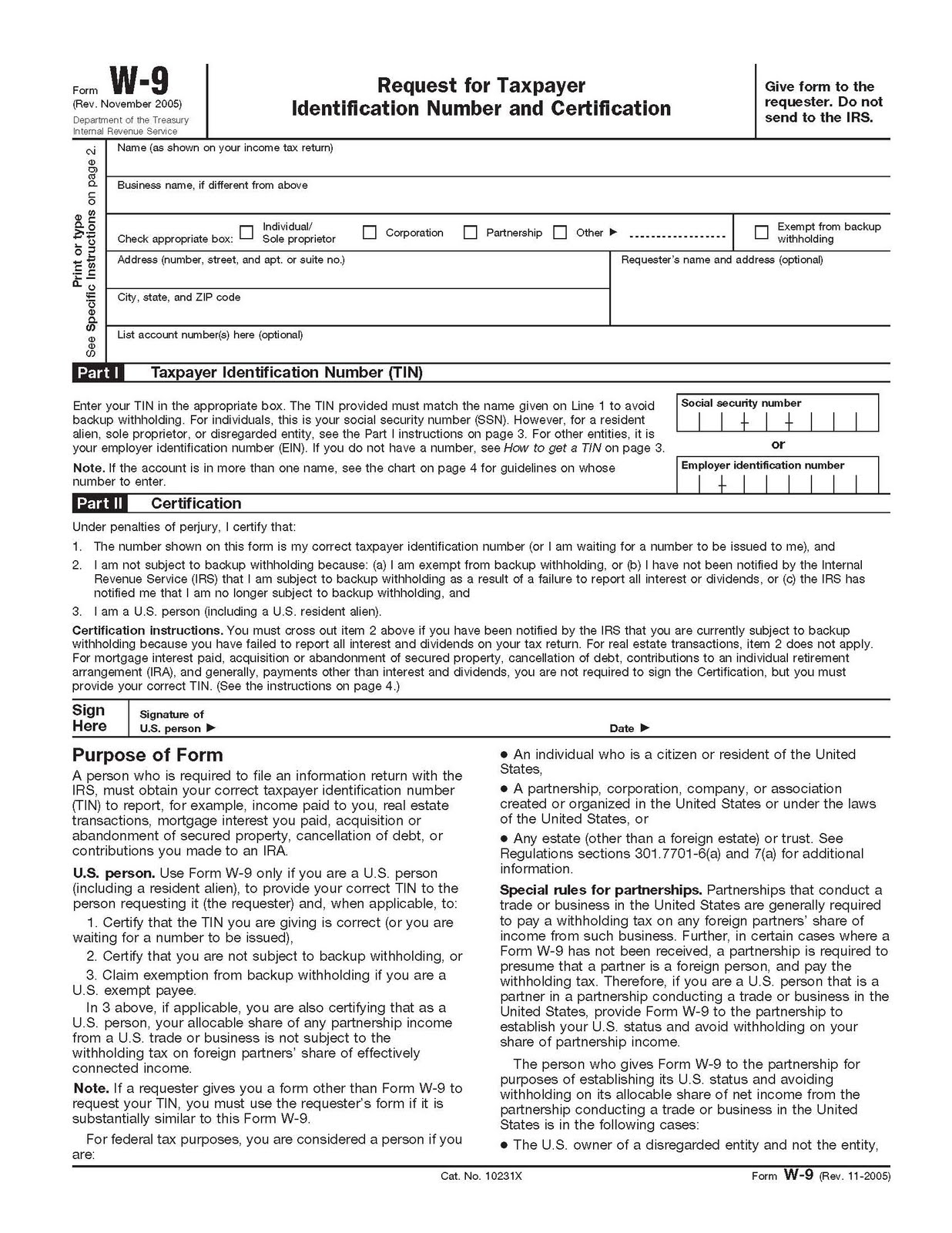

The W-9 form, officially known as the “Request for Taxpayer Identification Number and Certification,” is a form used in the United States to gather information about an individual’s or business’s taxpayer identification number (TIN). This form is primarily used by businesses to obtain the necessary details from independent contractors and freelancers to report income paid to them over the course of the year.

Purpose of the W-9 Form

The main purpose of the W-9 form is to provide the payer with accurate information needed to complete a 1099 form at the end of the year. The 1099 form reports the total amount paid to an independent contractor or freelancer, which the IRS uses to verify income reported on tax returns. Ensuring the information on the W-9 is correct is crucial for both parties to avoid discrepancies and potential audits.

Who Needs to Fill Out a W-9 Form?

The W-9 form is typically required in scenarios where an individual or business is paid for services rendered, but not as an employee. Common situations where a W-9 is necessary include:

- Freelancers providing services to a business.

- Independent contractors working on specific projects.

- Individuals earning interest or dividends from investments.

- Landlords receiving rental income.

Essentially, if you are receiving payment outside of a traditional employer-employee relationship, you may be asked to fill out a W-9 form.

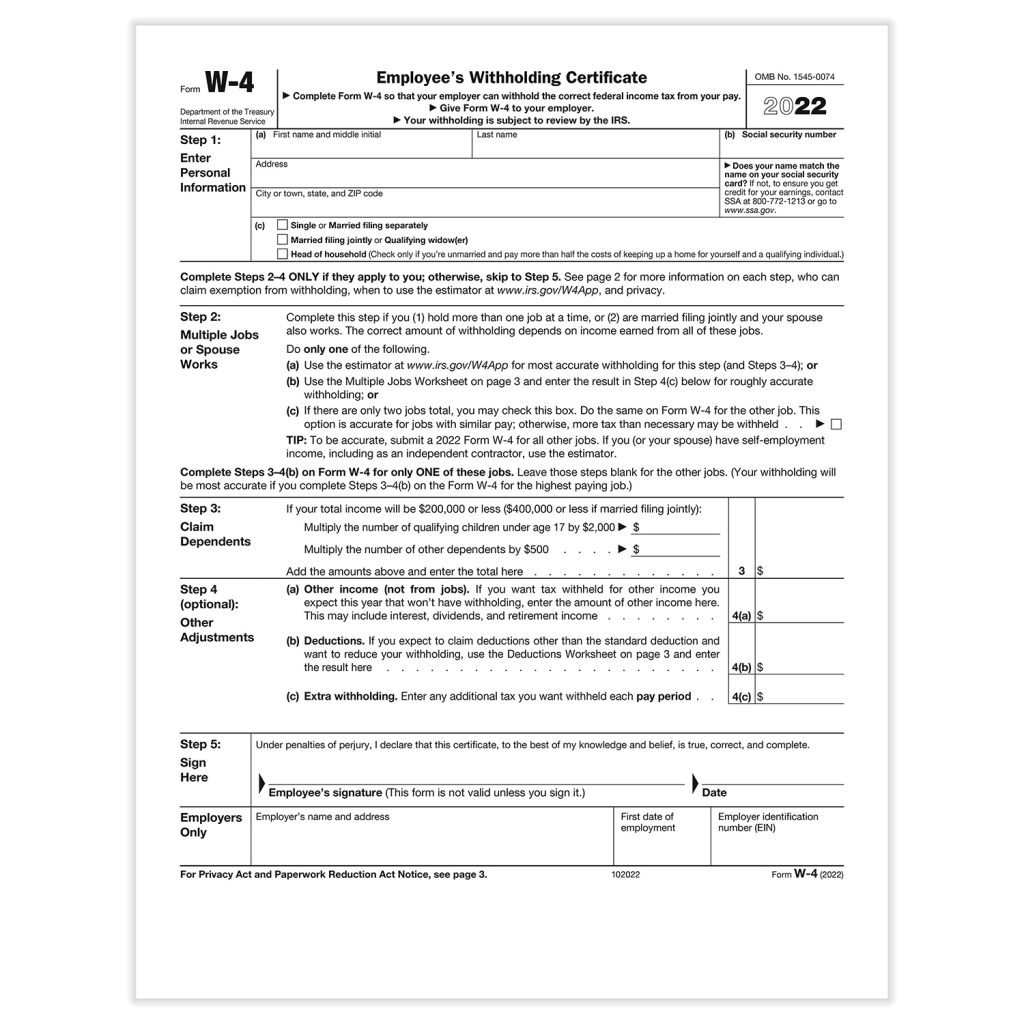

How to Fill Out a W-9 Form Correctly

Filling out a W-9 form accurately is essential to ensure compliance with IRS regulations. Here is a step-by-step guide on how to complete the form:

- Enter Your Name: Provide your full legal name as it appears on your tax return.

- Business Name: If applicable, enter your business name or “doing business as” (DBA) name.

- Federal Tax Classification: Select the appropriate tax classification for your entity (e.g., individual, corporation, partnership).

- Exemptions: If your entity is exempt from backup withholding, provide the relevant code.

- Address: Enter your address where you receive mail.

- Taxpayer Identification Number (TIN): Provide your Social Security Number (SSN) or Employer Identification Number (EIN).

- Certification: Sign and date the form to certify that the information is correct.

It’s important to double-check all information for accuracy to avoid any issues with the IRS.

Why Accuracy on the W-9 Form Matters

Providing accurate information on the W-9 form is crucial for several reasons:

- Avoiding Penalties: Incorrect or incomplete information can lead to penalties from the IRS.

- Ensuring Proper Tax Reporting: Accurate details ensure that income is reported correctly, preventing discrepancies in tax filings.

- Facilitating Smooth Transactions: Correct information helps businesses issue accurate 1099 forms, streamlining the tax reporting process.

Common Mistakes to Avoid

While filling out a W-9 form might seem straightforward, there are common mistakes that individuals and businesses should avoid:

- Using Incorrect TIN: Ensure that you provide the correct SSN or EIN to match your tax records.

- Failing to Update Information: If your information changes, such as a new address or business name, update your W-9 promptly.

- Omitting Signatures: Make sure to sign and date the form to validate the information provided.

The W-9 form plays a vital role in the tax reporting process for both individuals and businesses. By understanding its purpose and ensuring accurate completion, you can avoid potential issues with the IRS and ensure smooth financial transactions. Whether you’re a freelancer, contractor, or business owner, taking the time to fill out the W-9 form correctly is an essential step in managing your financial responsibilities.

Remember, the key to a successful tax season is organization and attention to detail. By following the guidelines outlined in this article, you can confidently navigate the requirements of the W-9 form and focus on what matters most—growing your business and achieving your financial goals.